EPF Withdrawal:An application to withdraw money from an EPF account can be made only if you are unemployed or retired. 75% of the money can be withdrawn from the EPF account after 1 month of unemployment and 25% of the rest after 1 month. You can fill the claim online EPF withdrawal form to withdraw money. But you can apply online only when your Aadhaar is linked with your UAN.

EPF Withdrawal Online Process

To fill the EPF withdrawal form and apply online, follow the below mentioned method:

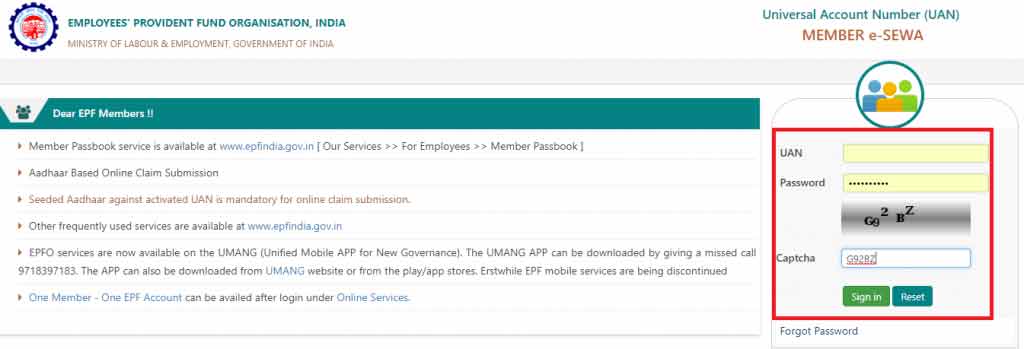

Step 1: With the help of UAN and password UAN member portal to log-in

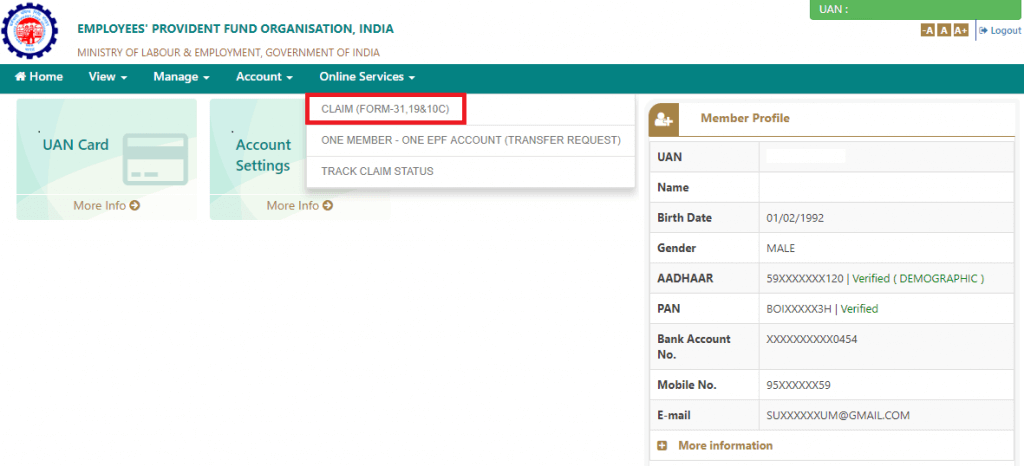

Step 2: Then click on the ‘Online Services’ tab and select ‘ Claim ( Form-31 , 19 & 10C) ‘ from the drop down menu .

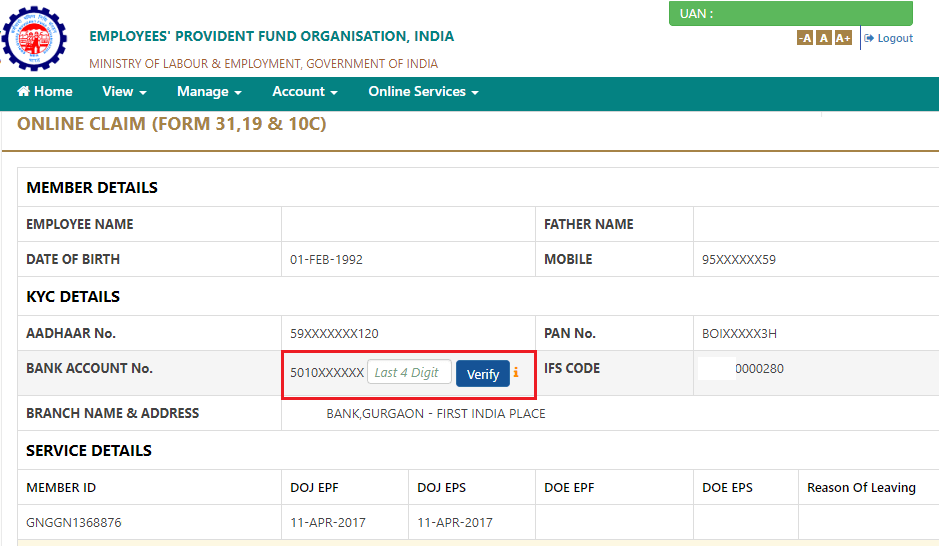

Step 3: Member information will appear on the screen. Enter the last four digits of your bank account and click on ‘Verify’

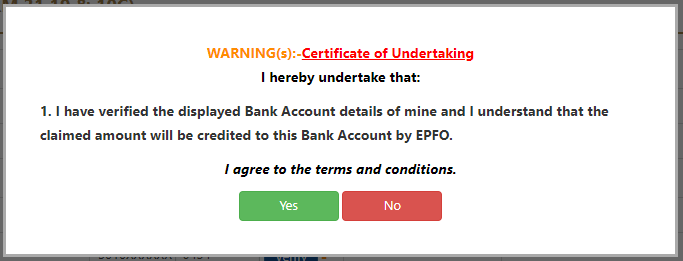

Step 4: Click on Yes to move it forward

Step 5: Now click on ‘Proceed For Online Claim’ option

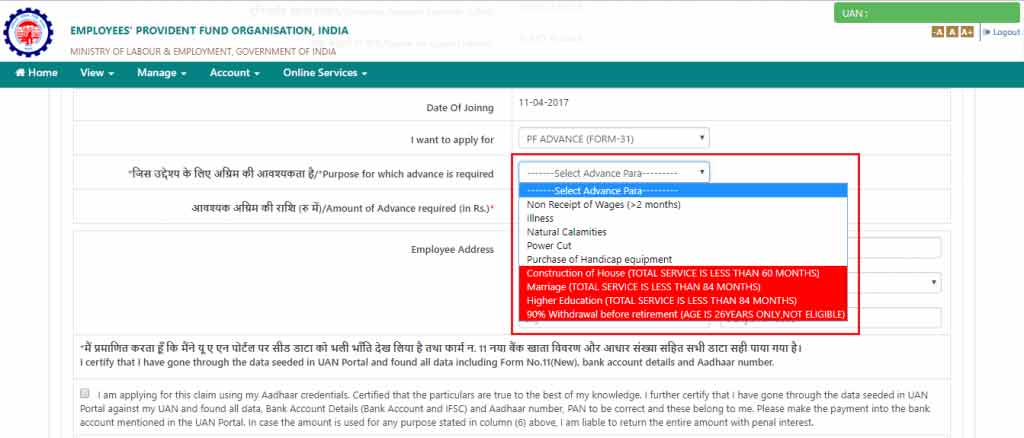

Step 6: Select ‘ PF Advance (Form 31) ‘ to withdraw your funds online

Step 7: From here a new part of the form will open where you will have to give this information, the purpose for which the money is being withdrawn , how much amount to withdraw and the address of the employee

Step 8: Tick the certification and submit the application.

Step 9: You have to submit the scan documents related to the purpose you will tell for withdrawing money.

Step 10: To withdraw money from EPF account , you have to take approval from your employer / company only after that money will be deposited in your bank account.

A notification will be sent to your mobile number registered in EPFO. When the application process is complete, the money will come to your bank account. The money usually arrives in the bank account within 15 to 20 days, however, the EPFO has not given any time limit from itself.

Eligibility conditions for withdrawal from EPF account

Following are the eligibility conditions for withdrawal of funds from EPF account:

- Money can be withdrawn only after retirement. EPFO considers retirement only when the person is over 55 years of age.

- Withdrawal of funds from EPF account is allowed only in case of medical emergency, house purchase or construction or higher education

- EPFO allows withdrawal of 90% of the amount before retirement 1 year

- The entire amount can be withdrawn from EPF account if the employee faces unemployment before retirement

- According to the new rule, only 75% of funds can be withdrawn after 1 month of unemployment. The balance will be transferred to a new EPF account after getting employment.

- Employees are not required to obtain permission from their employer / company to withdraw their EPF. By connecting UAN and Aadhaar to your EPF account, you get online permission.

- While making the claim online, you should have-

- An active UAN number

- Bank information is associated with UAN

- PAN and Aadhaar information that are included in the EPF database

EPF Withdrawal Form

When applying online to withdraw money, you will get three EPF withdrawal forms.

- PF Advance (Form- 31)

- Only PF Withdrawal – Form 19

- Only Pension Withdrawal – Form 10C

EPF Advance / Partial Withdrawal – Form 31

An EPF member can withdraw part of the amount deposited from the EPF account by filling Form 31 in an emergency even while doing the job. Even if you are withdrawing money due to unemployment, you will still have to fill Form 31. The reason for withdrawing money should be written in the form. Approval of application amount depends on the amount withdrawn amount and how much money is deposited in the EPF account.

EPF Complete Withdrawal / Final Settlement – Form 19

This form is filled after retirement to withdraw the entire amount deposited in the PF account. It is also known as the ‘Final Statement’. You have to fill your personal and application information like date of leaving company / institute, reason for leaving job, date of joining job, PAN , UAN and Aadhaar number , bank account information, postal address etc.

Pension Withdrawal – Form 10C

Form 10C should be filled to withdraw the pension amount. If you are withdrawing PF on the basis of unemployment, then you have to fill Form 31 and Form 10C. This is similar to Form 19 . The pension amount is controlled by the Employees Pension Scheme, 1950, while the PF amount is controlled by the Employees Provident Fund Scheme, 1952. So if you have to withdraw both PF and pension amount, then you will have to fill two different forms.

Composite Claim Form

To apply for withdrawal of money offline, you have to fill the Composite Claim Form which fulfills the purpose of three forms, Form 19 (for PF ) , Form 10 C (for Pension) and Form 31 ( part of PF Amount) ).

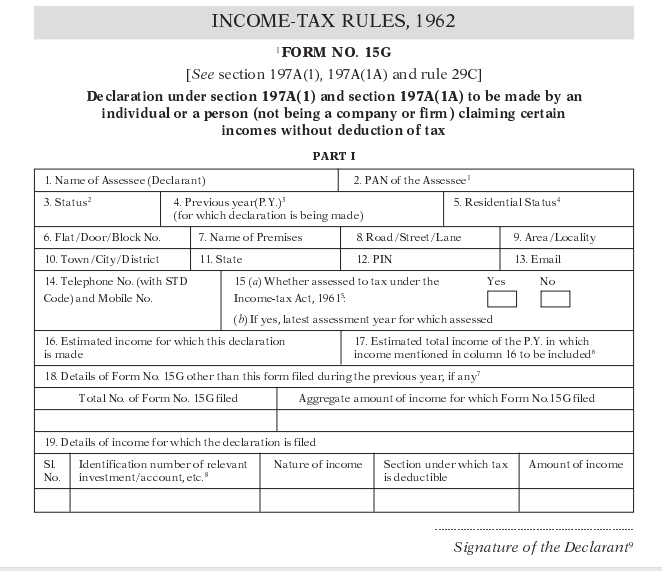

How to Download EPF Form 15G

EPF Form 15G for reduction in TDS burden can be downloaded for free from the website of all major banks in India. However, this form can also be downloaded from the Income Tax Department website.

Click here to download EPF Form 15G for free

How to Fill EPF Form 15G for PF Withdrawal

Now that you have an idea about the TDS rules that are applicable to EPF and also what is Form 15G or 15H, let’s move on and understand the process of how to fill Form 15G for online EPF withdrawal.

- Login to EPFO UAN Unified Portal for members.

- Click on the ONLINE SERVICES option – Claim (Form 31, 19, 10C).

- Verify the last 4 digits of your bank account

- Below the option, ‘I want to apply for’, click on Upload EPF form 15G as depicted in the image

Eligibility Criteria for Submitting EPF Form 15G

One must fulfill the following eligibility criteria to submit EPF Form 15G:

- You are an Individual or a person (other than company or a firm).

- You must be a resident Indian for the applicable FY

- Your age should not be more than 60 years

- Tax liability calculated on the total taxable income for the FY is zero

- Your total interest income for the financial year is less than the basic exemption limit.

Key Features of EPF Form 15G

The following are key features of EPF Form 15G:

- EPF Form 15G is a self-declaration form for seeking non-deduction of TDS on specific income as annual income of the tax assessee is less than the exemption limit.

- The rules for this specific self-declaration form are mentioned under the provisions of Section 197A of the Income Tax Act, 1961.

- The structure of EPF Form 15G has undergone considerable change in 2015 to ease the compliance burden and cost for both tax deductor and tax deductee.

- The current format of EPF Form 15G and Form 15H (the senior citizens variant for EPF Form 15G) introduced by CBDT (Central Board of Direct Taxes)

- EPF Form 15G can be submitted by individuals below the age of 60 years. Any individual above 60 years falls in the category of senior citizens.

- Form 15H, though similar in many ways to EPF Form 15G, can only be utilized by senior citizens.

- To avail the benefit, this declaration needs to be submitted in the first quarter of the financial year in case of existing investments. However, for new investments EPF Form 15G can be submitted before interest is credited for the first time.

Instructions to fill out EPF Form 15G

EPF Form 15G has two sections. First part is for the individual who wants to claim no-deduction of TDS on certain incomes. The following are the key details you need to fill out in the first portion of EPF Form 15G:

- Name as mentioned on your PAN Card.

- Permanent Account Number. Valid PAN card is mandatory to file EPF Form 15G. If you fail to furnish valid PAN details, your declaration will be treated as invalid.

- Declaration in EPF Form 15G can be furnished by an individual but not by a firm or company.

- Previous year has to be selected as the financial year for which you are claiming non-deduction of TDS.

- Mention your residential status as resident individual because NRI are not allowed to submit EPF Form 15G.

- Mention your communication address correctly along with PIN code.

- Provide valid email ID and contact number for further communications.

- Tick mark ‘’Yes’’, if you were assessed to tax under the provisions of Income Tax Act, 1961 for any of the previous assessment years.

- Mention the latest assessment year for which your returns were assessed.

- Estimated income for which you are making declaration needs to be mentioned

- Total estimated income for the financial year (which includes all the income)

- If you have already filed EPF Form 15G anytime during the financial year, then the details of previous declaration along with aggregate amount of income needs to be mentioned in the present declaration.

- Last part of the section 1 talks about the investment details for which you are filing declaration. You need to furnish the investment account number (term deposit/ life insurance policy number/ employee code etc)

- After filling the entire field, re-check all the details to ensure there is no error.

Second part of EPF Form 15G is to be filled out by the deduct-or i.e. the person who is going to deposit the tax deducted at source to government on behalf of the tax assesses.

How to fill EPF Form 15G Online

Most banks in India now provide the option of filling out and submitting EPF Form 15G online. Having an operational internet banking login is mandatory for availing this facility. Here’s how you can do it:

- Log into your bank’s internet banking with applicable User ID and Password

- Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed.

- On the same page, you should have the option to generate EPF Form 15G and Form 15H. Click on the available link to open the fillable form option.

- Once the form is opened online in fillable format, start filling out the details and information very carefully.

- Mention the branch details of the bank with which your FD/RD is held. If you do not have these details handy, use the bank’s branch locator tools to easily find the required details.

- Fill out all other details pertaining to your investment without any error and submit it.

When the TDS is Applicable?

In case, the employee wishes to withdraw his/her EPF amount which is more than or equal to Rs.50, 000 with less than 5 years of service.

1) TDS is deducted at 10% if an employee submits the PAN Card (But EPF form 15G form for EPF/15H is not submitted).

2) TDS will be deducted at the rate of 34.608% if an employee fails to submit the PAN Card. (Also EPF Form 15G/15H is not submitted).

When the TDS is not Applicable?

1) When one transfers their EPF account to another account.

2) Termination of service happened due to ill-health of the employee, discontinuation of business by an employer, completion of a project or other cause beyond the control of an employee.

3) If an employee withdraws the EPF amount after a total of 5 years of service (Including the service with a former employer).

4) If the EPF amount is less than Rs.50, 000, but the employee has rendered service of below 5 years.

5) In case the employee withdraws more than or equal to Rs.50, 000, with the employment of fewer than 5 years, but submits EPF Form 15G/15H along with PAN Card.

Required documents

To withdraw money from an EPF account, the following documents should be in place:

- Claim form

- Two revenue stamps

- Bank account statement

- identity card

- Address certificate

- A cancel blank check with account number and IFSC code

- Personal information like father’s name, date of birth etc. match with the information of identity card

If the employee withdraws money from the EPF account before the completion of five years of service, then he / she will also have to apply ITR Form 2 and 3.

EPF Claim Status

The status of withdrawal of money from EPF account can be seen on EPF member portal . You have to login to the portal and select ‘ Track Claim Status ‘ in the ‘ Online Services ‘ section . You do not have to provide any other number for this. The status will appear on the display.

Benefits of online application for withdrawal of EPF amount

It has many benefits like-

- Withdraw money easily:You do not have to go to the PF office by applying online and you are saved from getting in line. All you have to do is fill the online form.

- Processing time decreases: Amount in online application process arrives in your bank account within 15 to 20 days.

- No need to go to previous company / institute for verification:Where in case of offline application, you have to attest documents from the company / institute, in the case of online, this verification becomes automatic. These are beneficial for those who move from one city to another.

Limit on withdrawal of EPF amount

An employee can withdraw funds from his EPF account only in the following situations:

1. House Building / Purchase

- Employee must be in continuous service for 5 years

- Only PF account holders, and their spouses can apply to withdraw money

- The amount that can be withdrawn is limited to 24 times the monthly salary for purchase or 36 times the monthly salary in case of purchase and manufacture (both).

2. Home loan payment

- Employee must be in continuous service for 3 years

- Only PF account holders, and their spouses can apply to withdraw money

- 90% amount can be withdrawn

3. home repair

- The employee should be in continuous service for 5 years from the date of completion of house construction

- Only PF account holders, and their spouses can apply to withdraw money

- An amount equal to 12 times the monthly salary can be withdrawn

4. Marriage

- An employee must be in continuous service for 7 years

- PF account holders, their siblings and / or children can apply to withdraw money

- 50% of the employee’s contribution with interest can be withdrawn

5. Medical treatment

- There is no condition for minimum working time

- PF account holder, his parents, spouse or children can apply to withdraw money

- An amount equal to the employee’s contribution to EPF account with interest or 6 times of his monthly salary, whichever is less, can be withdrawn.

Tax on withdrawal from EPF account

Tax is not levied on withdrawal of funds from EPF account. But with the following conditions:

- The employee must have done EPF account for a minimum of 5 years. Before withdrawing money, tax has to be paid

- 50,000 from EPF account before five years. Tax will be levied on withdrawing more than Rs.

- If the employee gives his PAN no, then he will have to pay 10% TDS otherwise TDS rate will be 30%. Tax will also be deducted along with TDS if PAN is not given.

- If the income of the employee does not come under tax, then he has to apply Epf Form 15G / 15H

- If an employee transfers his EPF fund to the National Pension Scheme, he will not be taxed.

- How much tax an employee has to pay for withdrawing money depends on his income and in which year the money is being withdrawn.

Related questions

questions. Does 15G / H form also have to be filled while filling EPF withdrawal form ? Answer: If you apply to withdraw money from EPF account after five years of job, then it is not taxed. If you withdraw the EPF amount before five years, you will have to pay tax on it. So if you apply EPF Form 15G / H , no tax will be deducted from the amount.

questions. How much tax do I have to pay if I withdraw money before five years ?

Answer: If the EPF amount is Rs 50,000. 10% tax and Rs 50,000. There is no tax on the amount less than Rs. If you do not have a PAN card and you get Rs 50,000. 34.608% if we withdraw more than Rs. Will apply.

questions. How much money can I withdraw from EPF account ?

Answer: It depends on what purpose you are withdrawing money from.

| Purpose to withdraw EPF Amount | Withdrawal limit |

| Medical | Small portion of the total amount or six times the monthly salary |

| wedding | 50% of PF contribution |

| Home loan payment | Up to 90% of EPF |

| Home repair | 12 times monthly salary |

| Retirement | Total EPF Amount |

| Unemployment | 75% can be withdrawn after 1 month of unemployment and 25% of the rest after 1 month. |

questions. What are the terms of withdrawal of EPF for home loan payment ? Answer: The first condition is that you have completed 3 years in the job. You can withdraw up to 90% of EPF account for home loan payment.

questions. Can I apply to withdraw EPF Amount without logging into EPF portal ? Answer: If you do not want to use the online application, then you can apply online to withdraw the EPF amount. If you want to use online medium then you have to log in to EPF portal using UAN and password.

questions. If my UAN is linked to my current PF account and I have to withdraw money from my previous company’s PF account, what do I need to do for it ?

Answer: If your UAN is linked to your current PF account, then you cannot withdraw money from your previous company’s PF account. For this, you have to transfer the amount from the old PF account to the current PF account. To transfer, log in to the EPF member e-Seva portal and select “One Member-One EPF Account (Transfer Request)” in ” Online Services” .

However, if you are unemployed for the last two months, you can apply for withdrawal of the complete EPF amount by filling Form 19.

questions-. Is PAN mandatory to withdraw EPF Amount ?

Answer: EPF amount can also be withdrawn without PAN, but if PAN is not available, you will have to pay more tax on the amount withdrawn. If there is no PAN, you will have to pay 34.6% tax on the withdrawn amount.

questions. How many times can I withdraw money from a PF account before retirement ?

Answer: You can apply for withdrawal of PF account money many times before retirement, but for that reason will have to be given. You can withdraw money before retirement for the following purposes:

- You can withdraw money for marriage but not more than three times

- You can withdraw 3 times for studies after 10th

- If you are buying or building a house or land, then you can withdraw money just once.

- How many times you can withdraw money from EPF account for medical emergency before retirement

Also Read : How to Download EPF Form 15G

Thanks For Visiting this website any doubt you can comment below, you want to latest updates this type of useful information just follow on Google News.