Renovating your home can not only improve its appearance but also add value and functionality. Even if you have many ideas for home remodeling, interior design the most significant challenges arise when it comes to actually pay for your project. There are many options where to get money for home renovation. Each of them has its own pros and cons. Explore them all to decide which is best for you for Money For Home Renovation.

How to Create the Right Budget and money for Home Renovation

By taking time to understand the different home renovation financing options, you’ll feel better equipped to confidently choose the one that best meets your financial situation and goals.

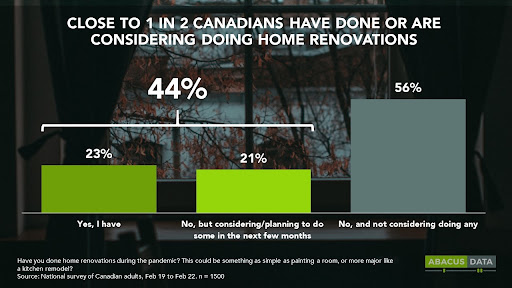

Ever since the COVID-19 pandemic hit Canadians’ lives, they have been spending a lot more time at home. In many cases, this has inspired home renovations.

New consumer research suggests 23% of Canadians have completed a renovation in the past year and an additional 21% are considering a renovation in the near future.

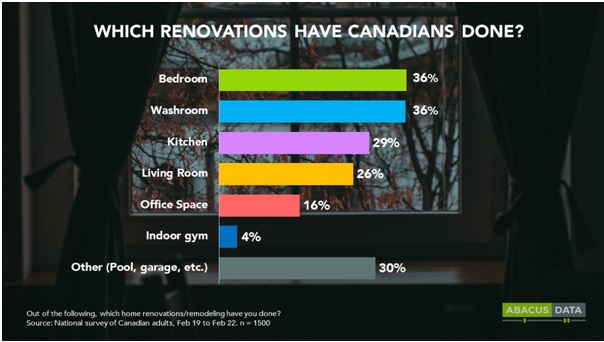

In some cases, remote work made it necessary to build a new space. This is the so-called home office. Other people reminisce about overdue cosmetic updates and are using this time to complete repairs around the house.

Understand what is the best way to spend your money. Before jumping into demolishing your kitchen or picking out new bathroom fixtures, spend some time planning, preparing, and educating yourself on the best ways to spend to improve and update your home.

It is important to understand your financial level – what it is and how much money you need to borrow. Perhaps you can make a table with your own hands. It is not necessary to buy a new design table for this. Create it yourself!

Home Renovation Expenses

Many people ask: “How much will it cost to renovate my house?”

You probably don’t want to spend more than 10 to 15 percent of your home’s value on a single room. If you spend more, the value of the renovation will not proportionally add to the value of your home.

For example, if your home is worth $100,000, the maximum you should spend on a kitchen or bathroom renovation is $15,000. If your house is worth more, spending on a renovation could be higher.

Determine funding for home renovations before starting. Decide how you are going to finance the renovation. It can be from your own money or a loan. Once you know your budget set aside 10 to 20 percent of your available funds for unexpected expenses. It is very important.

Something may cost more than you thought. By setting aside a percentage before beginning, you will be sure that you will have funds until the project is completed anyway.

Where to Take Money If It’s Not Enough

If you do not have your own money, we have several ways where to get money for home renovations. Here is some of them:

#1 Payday Loan

They can help you pay for unexpected car repairs and other emergency expenses by your next payday. Unlike an installment loan, the balance of a payday loan is generally due in full by your next pay date.

#2 Personal Loan

A personal loan typically has a lower interest rate than a credit card. You repay it in regular payments over a set period, usually 1 to 5 years. Once the loan is repaid, you must reapply if you wish to borrow more.

You can consolidate debt, cover unexpected expenses, and more with personal loans in Ontario. You can also connect with a Lending Specialist online or by phone to complete the loan application from home.

The single biggest risk to taking out a personal loan is not being able to afford to keep your commitment to your lender. If your monthly loan payment is too high for you to make. You default on your loan. You could find yourself dealing with serious financial consequences.

#3 Installment Loan

An installment loan is a loan type in which you have to repay the loan in regular installments over a certain period. Each payment includes a portion of the principal plus interest.

#4 Ask Your Family

As Global News recently reported, more young Canadians find themselves borrowing from the BOMAD (Bank of Mom and Dad) to finance home purchases, so it’s reasonable to assume that some Canadians are also lucky enough to borrow from a family member to help pay for home renovations.

However, keep in mind that this could mean additional financial responsibility for you down the road, for example, it may delay their retirement if your parents tap into their savings for tomorrow in order to help you today.

#5 Save Money

It isn’t always necessary (or even possible) to borrow Money For Home Renovation to fix up home right away. You always have the option to save a little each week and pay for renovations as you can afford them.

In fact, some people make a conscious decision to update their homes without going into debt. You can finance small home renovations yourself, especially if you’re doing the work yourself.

#6 Sweat Equity (DIY)

One of the most expensive parts of the cost of home renovation is the cost of labor.

Many homeowners spend more money on paying workers than on materials. Knowing this, many people prefer to make repairs on their own with the help of family and friends.

In such cases, homeowners do not spend money on hiring a team of workers. If you are a physically healthy person, you can make repairs with your own efforts. This will save you a lot of money.

Friends will most likely help you with a bottle of beer or for a pizza. Do you feel the benefit? You can save thousands of dollars by working on your home yourself and by enlisting your friends.

Unfortunately, if you are not a professional, you will miss out on the technical expertise and quality that professional contractors can provide. You have to consider whether a potentially sub-par result is worth the money you will save on labor costs when it comes to your custom home renovations.

________________________________________________________________

Fortunately, there are many ways to pay for home renovations. We have considered the most common ones. Home renovation is fun, but don’t let your excitement lead to costly decisions or mistakes.

Take some time to select the right financing option as well as the renovations. The new renovation will add the features you want plus add value to your family home.

It’s impossible to say definitely which option is best when it comes to financing home renovations. It will be important for you to consult with a financial planning specialist, analyze all repair options and choose the best one for yourself.