When it comes to trading on financial markets like Forex, cryptos, commodities, and others the leading trading platform that is super popular among traders is MetaTrader 4 or MetaTrader 5. Both of these software offer similarly advanced functionality with the ability to automate the trading process. There are a few other trading platforms that have grown in popularity in the last few years and we will compare and discuss Metatrader alternatives in this guide below.

Points Takeaways

- If you are interested in learning more about MT5 EAs this could be the best MT5 EA guide that provides a comprehensive guide about MT5 EAs and where to find them.

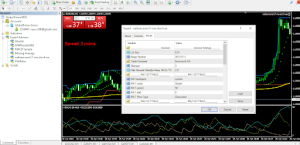

- MetaTrader 4 as well as MetaTrader 5 are among the best platforms that support full automation and customization with advanced trading robots called Expert Advisors (EAs).

- Several potent alternatives of MT4 and MT5 also offer trade automation including cTrader cBots and TradingView strategies.

- cTrader offers widely-available and popular programming language C# for, while MT4 and 5 platforms come with MQL5 language, and TradingView has the easiest language called Pine Script.

- All four trading platforms offer full automation for trading, but TradingView is the hardest to master due to its lack of supported brokers

- TradingView has the most appealing modern design and supports a multitude of devices and systems, with fewer limitations on mobile devices

- MT4 is the oldest and most popular trading platform with a bit of old design, while MT5 is its successor with added features

- cTrader offers many inbuilt social and copy trading features and it is possible to open different timeframes of a single security with one click

- No trading platform can beat TradingView’s visual appearance and dark mode period.

MetaTrader 4 and MetaTrader 5 trading automation overview

Mt4 and MT5 are very popular for both trading and trading robotsThe main reason is they come with inbuilt programming languages enabling you to write your trading indicators and robots. It is also possible to download and install an EA and run it. There are plenty of free EAs on the internet and both MT4 and MT5 have a huge community of programmers and traders. Another advantage is its vast amount of inbuilt indicators that can be used with just one line of code.

MT4 and MT5 pros and cons

Pros of MT platforms include

- Large community – MT4 is a very old platform that has accumulated a vast trader base who are using it as a daily driver for their trading activities, the platform also has mobile apps for Android and iOS making it even more attractive.

- Flexibility – supports custom scripts, trading indicators, and templates, and can be customized to your heart’s content

- Popular among best brokers – it will be hard to find a reliable broker that does not offer one of MetaTrader platforms to their traders.

Despite advantages, there are several downsides to MT platforms

- Complex programming – just like with other advanced platforms, programming robots with MT4 and MT5 require advanced programming knowledge and skills which will take considerable time to achieve

- Limited timeframes – TradingVIew offers much more timeframes than MT4 or MT5 and it is sometimes apparent when using custom trading strategies made by other traders.

Best MetaTrader 4 and 5 alternatives for trade automation

If you are looking for an alternative to MetaTrader platforms for trade automation you might be wondering what other popular platforms are out there that you can learn quickly and implement automated trading systems. The two main contenders for this place are cTrader and TradingView.

cTrader automation pros and cons

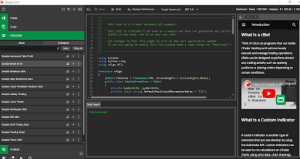

cTrader uses C# as its programming language and offers multiple libraries and inbuilt useful functions to summon and use indicators in cBots, an automated trading software inside the cTrader platform. There are numerous pros and cons associated with building and running automated robots in cTrader.

Pros of cTrader automation include:

- Widely used programming language – C# has a much bigger community than MQL language as it is a widely used programming language. This reduces the time a programmer needs to adapt to the cTrader’s environment and makes programming much more efficient.

- Backtesting – cTrader just like other platforms comes with advanced inbuilt strategy testing capabilities giving traders the ability to test the trading software on historical data. This enables traders to evaluate the cBot before launching it to live markets.

Cons of automated trading with cTrader’s cBots:

- Complex programming – it is not an easy endeavor to master C# and then write cBots by understanding how the cTrader’s API works. It takes considerable time and effort to familiarize yourself with programming language and C# is not known for its simplicity.

- Limited customization abilities – the API which cTrader provides is pretty powerful, but it has limitations when it comes to customization that can lead to inconveniences

- Limited brokerage support- cTrader is powerful but the brokers who offer it as a trading platform are limited. This can quickly become an issue when you have found a reliable broker and it only offers one of MetaTrader’s platforms.

TradingView automation pros and cons

TradingView excels at

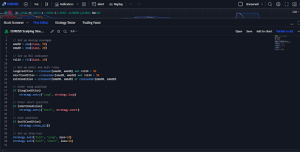

- The simplicity of Pine script – just like the Python language the Pine script is super simple to understand and learn as it does not require variables to be declared and everything is in plain English.

- Huge growing community – TradingView’s community is 30m+ and they constantly share their ideas and strategies including various indicators that can be used freely by anyone with the simple search feature

- Multiple timeframes and inbuilt functions – TradingView offers more time frames than any other platform in this list. It also has a base of inbuilt functions that make it easy to write your strategy or indicator

Despite being one of the most modern and best platforms TradingView still has some limitations versus others we discussed above

- It is hard to run automated trading strategies without advanced knowledge of other programming languages and the broker’s API

- The limited number of supported brokers – the number of brokers supporting TradingView is less than cTrader and it is hard to find and directly connect your broker to the platform.