ICICI Bank NEFT form pdf format Download : If you want to know about ICICI Bank NEFT form pdf format Download so this article is very important for you. In this article, we will discuss ICICI Bank NEFT Form,What is ICICI Bank NEFT form and ICICI Bank RTGS Form?,What is the Difference between ICICI Bank NEFT and RTGS?,what is the ICICI Bank NEFT Transaction Charges,what is the ICICI Bank RTGS Transaction Charges. I will explain each and every topic covers in details so read whole article.

So, read this article completely and then you will understand ICICI Bank NEFT form pdf format Download Never skip any paragraph.

ICICI NEFT stands for National Electronic Funds Transfers and ICICI RTGS stands for Real-Time Gross Settlement. NEFT and RTGS Both of these systems are used to make Money transfer or funds transfers. But they are not one and the same. There is a difference in ICICI Bank RTGS and ICICI Bank NEFT which I will be talking about in a while. On this page, you will find the download link of ICICI Bank NEFT and RTGS Form in PDF Format.

To download ICICI Bank NEFT form pdf format or ICICI Bank RTGS form pdf format Download the customer has to visit the official website of ICICI Bank. Go to the forms section and select NEFT and RTGS form. And the download of the form in PDF format will begin shortly. The download link provided below on this page can also be used to download the form.

What is NEFT and RTGS Form?

NEFT : NEFT – Use National Electronic Funds Transfer (NEFT) facility by ICICI Bank to transfer money to the beneficiary. National Electronic Funds Transfer is an Indian system of electronic transfer of money from one bank to another. It was introduced by Reserve Bank of India. It is an electronic fund transfer system that is based on Deferred Net Settlement (DNS) which settles transaction in batches. To download ICICI Bank NEFT form pdf format link provided below on this page can also be used to download the ICICI Bank Neft form.

RTGS : What is RTGS? The acronym ‘RTGS‘ stands for Real Time Gross Settlement, which can be defined as the continuous (real-time) settlement of funds individually. The term real-time gross settlement (RTGS) refers to a funds transfer system that allows for the instantaneous transfer of money and/or securities. RGTS is the continuous process of settling payments on an individual order basis without netting debits with credits across the books of a central bank.

Difference between NEFT and RTGS

RTGS and NEFT both are a way to money transfer. There is a minor difference between NEFT and RTGS. NEFT Money Transfer system is mostly used when someone wants to make a transaction of value less than Rs. 2,00,000. RTGS Money Transfer system is mostly used when someone wants to make a transaction of value Rs. 2,00,000 and above.

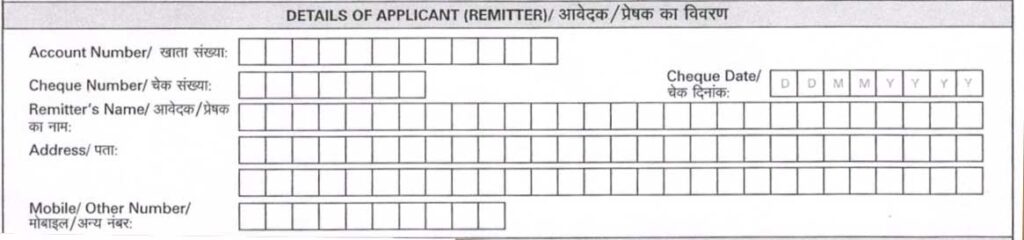

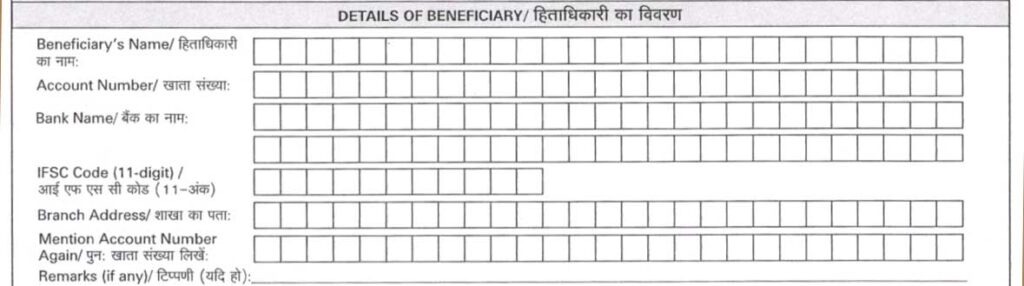

Details of ICICI Bank NEFT Form and ICICI Bank RTGS Form : There are two parts of NEFT Form or RTGS Form first one is Details of Applicant (remitter) and second Details of Beneficiary.

How to fill ICICI Bank NEFT Or RTGS Form in different section : First of all talk about first section that means Details of Applicant (remitter). In this part first of all fill Remitter’s Account Number If you want to deduct money from your bank accounts, or enter Cheque Number If you want to use Cheque for the NEFT or RTGS transfer. After that enter Remitter’s Name the person who wants to do the NEFT or RTGS transfer. And then fill Address details The address of the person who is initiating the fund’s transfer. After that enter Mobile Number the mobile number on which ICICI Bank can contact the remitted.

Second Part of ICICI Bank NEFT or RTGS form Section : Talk about second parts of ICICI Bank NEFT or RTGS Form Beneficiary Section. In this part first of all fill Beneficiary’s Name Mention The name of the person to whom you are sending the money. And then enter Beneficiary’s Account Number the bank account number of the beneficiary who is receiving the money should be mentioned. And then fill Bank Name the bank’s name where the beneficiary holds the account should be mentioned here. After that fill 11 digits (IFSC Code)Indian Financial System Code of the beneficiary’s branch. And then fill the Branch Address the address of the beneficiary’s home branch. After that and last Mention Account Number Again Re-write the same account number of the beneficiary again. Your ICICI Bank NEFT and RTGS form fill up successfully.

Download PDF of ICICI Bank NEFT or RTGS Form

Follow this link to download the ICICI Bank NEFT or RTGS Form in PDF Format.

ICICI Bank NEFT form pdf format Download

ICICI Bank RTGS form pdf format Download

ICICI Bank RTGS Transaction Charges

>Transaction Above Rs. 2,00,000 to Rs. 5,00,000 – ICICI Bank RTGS Charges 20 Rs + GST

>Transaction Above Rs. 5,00,000 to Rs. 10,00,000 – ICICI Bank RTGS Charges 45 Rs + GST

ICICI Bank NEFT Transaction Charges

>Transaction Up to Rs. 10,000 – ICICI Bank NEFT Charges 2.25 Rs + GST

>Transaction Above Rs. 10,000 to Rs. 1,00,000 – ICICI Bank NEFT Charges 4.75 Rs + GST

>Transaction Above Rs. 1,00,000 to Rs. 2,00,000 – ICICI Bank NEFT Charges 14.75 Rs + GST

>Transaction Above Rs. 2,00,000 to Rs. 10,00,000 – ICICI Bank NEFT Charges 24.75Rs + GST

I hope after read this article you can easily know about ICICI Bank NEFT form pdf format Download so this article is very important for you. In this article, we will discuss ICICI Bank NEFT Form,What is ICICI Bank NEFT form and ICICI Bank RTGS Form?,What is the Difference between ICICI Bank NEFT and RTGS?,what is the ICICI Bank NEFT Transaction Charges,what is the ICICI Bank RTGS Transaction Charges. Thanks For Visiting this website any doubt you can comment below, you want to latest updates this type of useful information just follow on Google News.